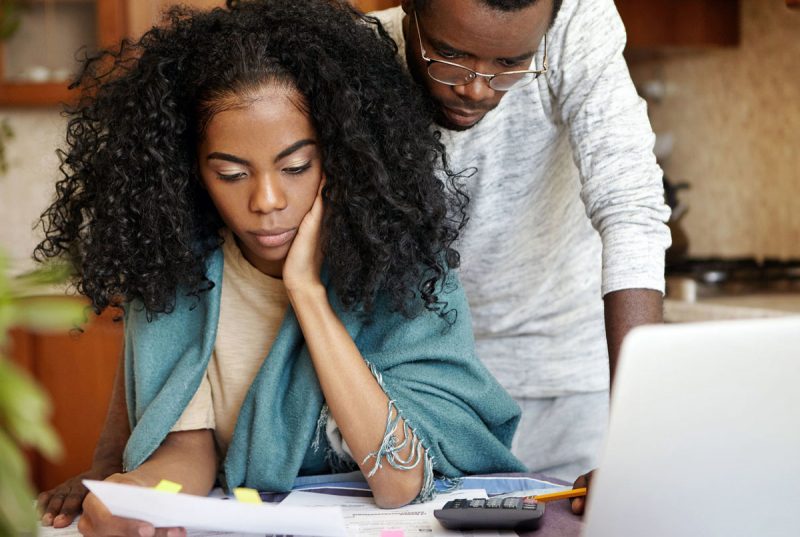

Another Tax Day has come and gone. It may have left you feeling a little deflated. Perhaps you are one of the lucky that is receiving a refund. Maybe you are wondering how to best utilize the extra money. Either way, after reviewing the final numbers you may have found yourself asking, “What did I do with all the money I earned last year?”

Chances are, like so many other Americans, you gave a chunk of your earnings to creditors last year. You do not need to carry too much debt to be a victim, either. Having any debt makes you subject to rising interest payments, annual fees, late fees, etc. Almost anyone who has debt has imagined a life without it, but one thing is certain… most could be well on the way to financial freedom by employing a prudent budget.

There are many ways to begin reducing and managing debt. Here we will cover the Snowball Method. This method has been praised for its success if given strict adherence. Many financial gurus give it a nod including Dave Ramsey and The Motley Fool.

There are differing thoughts on the best way to begin, but the end result for both is financial control. One school of thought says to begin with the debt that has the highest interest rate. By doing so you would save more money in interest payments. I do not dispute that. The other angle is to start with the debt showing the lowest balance. In this way, you get the emotional satisfaction of paying off bills more quickly. The theory is that this would motivate you to keep going. Ultimately, the choice is yours. Personally, I would choose plan B simply because I lack patience. I like to see results.

There are a variety of snowball calculators on the web. I “demo-ed” the one at vertex42.com. There is a video link that explains it all and the download is free. For the techno-savvy crowd, there is a smartphone app for nearly every platform.

Here are the basic steps:

- Write a monthly budget for yourself.

- Save aside an emergency pool (about $1000 for car repair, etc.)

- List your debts in descending order according to the method you prefer outlined above.

- Decide what your snowball amount will be. This should be the amount you can afford for total debt payments minus the minimum payments for all. Note: the total amount will be budgeted for bill payment every month, even after bills start getting paid off.

- Make the minimum payment on all accounts except for the one at the beginning of your list. This will be the debt with either the lowest balance or the highest interest. On this account make the minimum payment plus whatever snowball money you have.

- Continue in this fashion until the first debt is paid.

- The month after the first debt is paid in full, the minimum payment from the recently paid off debt plus the initial snowball money becomes the new snowball money.

- Again, pay minimum payments on all debts except for the next one on your list. That one gets its minimum payment plus the “new” snowball money. *Now you are getting somewhere.

- Continue until all bills are paid. It will happen sooner than you think.

Things to consider:

- The more debts you pay off the bigger the snowball gets. The bigger the snowball gets the quicker you pay off the next debt.

- Don’t pay late fees! Utilize online banking to pre-schedule payments.

- If you do accidentally go beyond the due date, call and ask for a fee waiver. If you are not a repeat offender, many companies will consider it.

- Ask for an interest rate reduction. The worst thing they can say is “no”.

- Read your statements. Over the years I have caught many errors. Most often, these are just computer-generated errors. Usually, it only takes speaking with a human to get the problem resolved. Be diligent. It’s your money!

- Once you have broken the chains do not slip back into the same pattern. Pay cash whenever possible.

This will take motivation. Try to imagine yourself debt-free. What would you do with the extra money each month? The results are closer than you may realize. Please send me your comments or suggestions that might help others.

savour…liberation